|

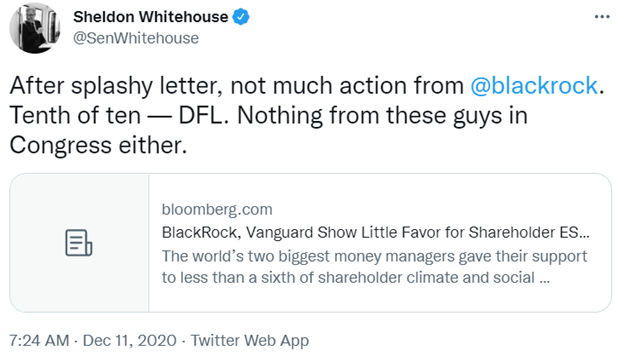

The Securities and Exchange Commission (SEC) says its proposed disclosure rule is necessary to meet a growing demand by investors for information on publicly traded companies’ climate change risk. Yet only a small fraction of American asset managers are interested in such regulations whereas the majority of the pressure is from Europe. Today, we get granular to further show the weakness of SEC’s case. The following continues our series based on our white paper that provides more detail. SEC justifies the proposed rule as necessary to meet “significant investor demand for information about how climate conditions may impact their investments. That demand has been increasing in recent years.” SEC cites to a well-known letter to investors in 2020 from BlackRock Chairman and Chief Executive Officer Larry Fink as proof of investor demand. Fink wrote that, “BlackRock announced a number of initiatives to place sustainability at the center of our investment approach,” including exiting investments in coal. Absent from SEC’s discussion is any reference to the robust public debate and criticism of BlackRock’s letter and its continued investments in the coal and oil sectors. Mr. Fink’s letter is presented by SEC as though it is widely popular and uncontroversial, and that cannot be further from the truth. For example, a coalition of major climate activist groups, known as #BlackRocksBigProblem, has criticized the asset management firm’s supposedly seminal letter to investors and lack of action. The group has accused BlackRock of still being “one of the leading investors in fossil fuel and deforestation companies.” The coalition includes the Sierra Club, Oil Change International, Rainforest Action Network, the Indigenous Environmental Network, the Union of Concerned Scientists, and several other well-known climate groups. The activist groups cited a report by Reclaim Finance and Urgewald that states, “BlackRock holds $85 billion in coal companies, $24 billion of which are invested in companies planning to expand their coal business.” The coalition also notes, “In late 2021, BlackRock finalized a $15 billion deal with Saudi Aramco to acquire 49% of the oil & gas major’s gas pipeline subsidiary.”

SEC also fails to mention that BlackRock has criticized federal policies limiting oil and natural gas production and is heavily invested in the industry. Reality set in for Larry Fink in October 2021, as gasoline prices reached new record highs and inflation was casting a pall over the wallets of American consumers and the minds of their elected representatives. He warned about the costly impacts associated with short-term climate policies that restrict fossil fuels. In an interview with Bloomberg News, Fink said, “Inflation, we are in a new regime. There are many structural reasons for that. Short-term policy related to environmentalism, in terms of restricting supply of hydrocarbons, has created energy inflation and we are going to be living with that for some time.” Five months later, BlackRock President Rob Kapito stressed his company’s financial interest in oil and natural gas investments. Speaking at the Texas Independent Producers and Royalty Owners’ (TIPRO) annual convention, he said, “BlackRock is the biggest investor in oil and gas. Nothing about our strategy with respect to the energy industry has changed. Not because of the new bill, not because of the media. We gotta get over a lot of the media hype—we are investing in fossil fuels. People talk a lot about the transition, but this is not a transition. It’s an evolution.” While we’re pleased BlackRock has adjusted to reality and the need for oil and natural gas, SEC seems not to have learned the lessons of high energy prices and continues in its quest to stifle American production by seeking to deny financing through this rule. At a minimum, SEC should strike all references to the original BlackRock letter, as it is not legitimate evidence to support its climate change disclosure rule. More details on this topic and several other shortcomings of SEC’s climate change disclosure rule are available in our white paper and in our full comments on the proposed rule. This is the second in a series of posts on SEC's climate disclosure rule. Read the first post here. Comments are closed.

|

Archives

June 2024

Categories |

RSS Feed

RSS Feed